Owning a car is a goal for many people. There’s something to be said for the pride of ownership and being able to say, “This car is mine, free and clear.” But while owning a car has its merits, both psychological and financial, it isn’t always the best option. In fact, sometimes leasing makes even more financial sense.

During uncertain times, like the current pandemic, when having more financial flexibility is important, leasing can be a more enticing option. Leases often have shorter-term options and require lower upfront payments, which can be easier to handle when you aren’t sure what the future holds. Leases are also easier to get out of, should you need to break the contract early.To learn more about the lease versus own argument, we surveyed over 1,000 people who have bought or leased a car. We asked why they would buy a vehicle and why they would lease, and who regretted their decision – and what to do if you get into a lease you do regret. Keep reading to see what we found out.

To Buy or Not to Buy, That Is the Question

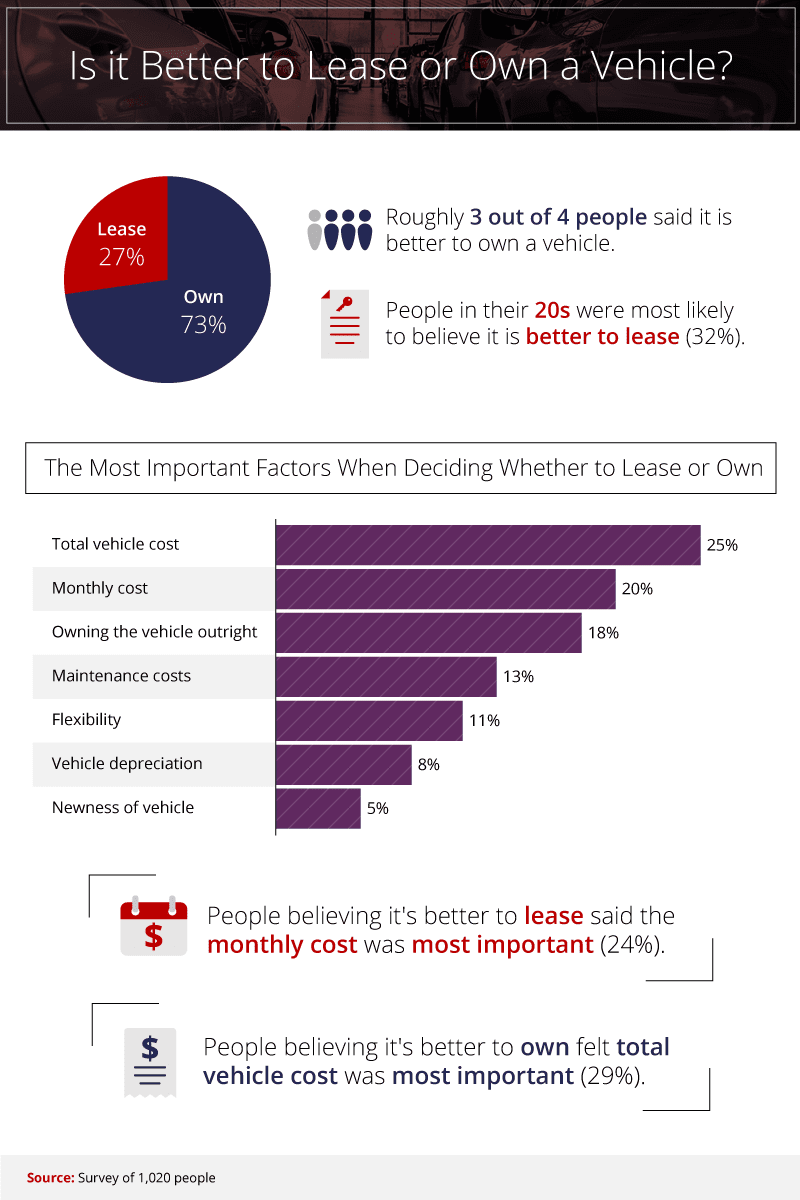

Traditionally speaking, buying a used car is a smarter financial move than leasing – and 3 out of 4 people agreed it’s better to own. Once you’re done paying it off, you’ll own the car. With a lease, you walk away with nothing but the need for another car. Likewise, since vehicles lose the most value in their first year off the lot, getting a car that’s already a couple years old can also save you from the sharpest years of depreciation. In a lease, you’re making payments into a vehicle that’s rapidly depreciating in value. But buying a car outright – even a used car – can require a significant outlay of cash and longtime commitment.

When asked the most important factor in deciding whether to lease or buy, it ultimately came down to total cost versus monthly cost. People preferring to own cited total cost as most important in their decision to own rather than lease. Meanwhile, people leasing said monthly cost is the most important.

When to Lease and When to Own

Whether it’s best to lease or own a vehicle often comes down to personal preference and what you value most. If you like to upgrade your car how many people do their cellphones, then leasing would naturally make more sense. On the other hand, if you want to know there will eventually be an end to your car payments, you’re better off owning.

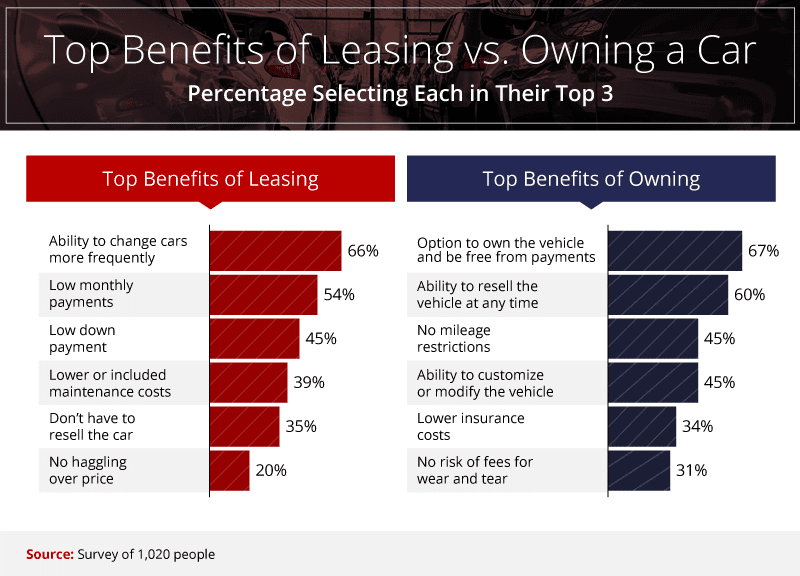

To better understand the leasing versus owning argument, we asked people to choose the three top benefits in favor of each side. The most highly ranked benefits of leasing were the ability to change cars more frequently, low monthly payments, and low down payment. On the owning side, people ranked the ability to eventually pay off the vehicle or resell it and having no mileage restrictions as the top benefits.

Someone who likes new cars but doesn’t want to have to sell their old car every time they want a new one would likely prefer leasing. Meanwhile, someone who does a lot of driving and likes to customize their vehicle would probably be better off owning.

On the financial side, there’s also a debate between insurance costs and maintenance costs. Insurance can be more expensive with leased vehicles, as you may need to pay for more than just the minimum coverage. But when you buy a car, you’re on the hook for long-term maintenance costs.

The Hidden Costs to Leasing

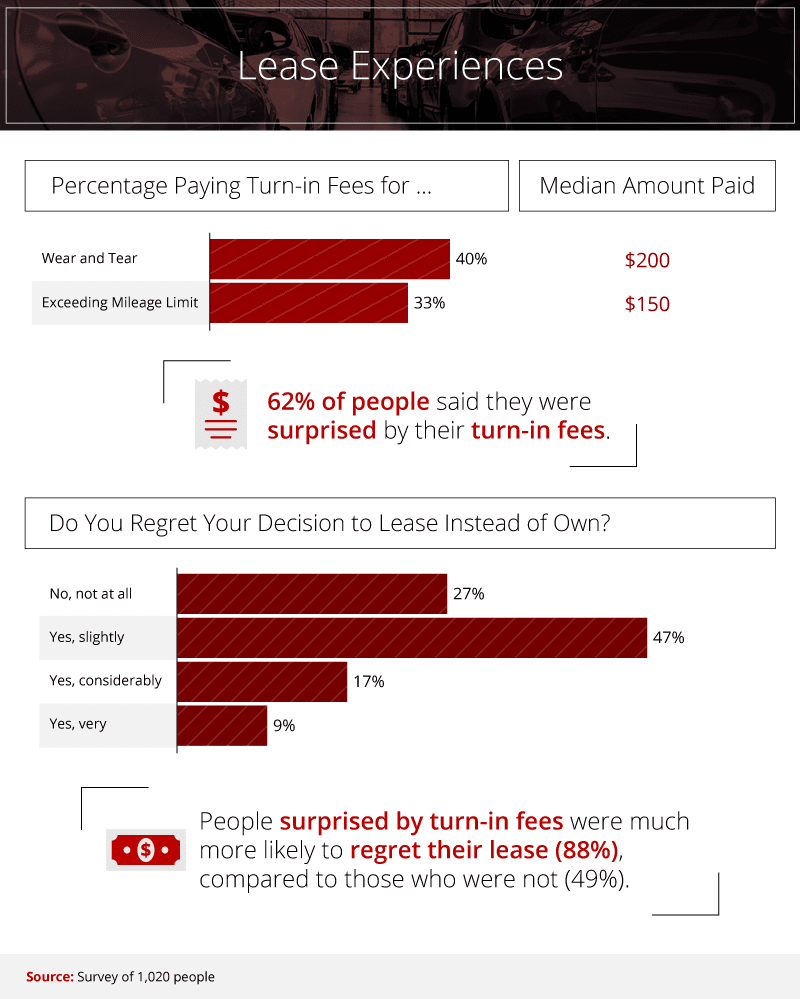

Leases can look less expensive up-front, with lower- or shorter-term monthly payments, but they are notorious for having hidden fees or add-on costs that can take you from affordable to excessive in no time. For instance, one of the biggest surprise fees you could face on a lease are their turn-in fees.

Over 6 in 10 people who’d completed at least one lease said they were surprised by turn-in fees. Two of the most common turn-in fees were wear and tear and exceeding the mileage limit on their lease. Forty percent of people who’d completed at least one car lease were charged a turn-in fee for wear and tear at the end of their lease. The median wear and tear fees incurred was $200. Additionally, one-third of people completing a lease were charged for exceeding their mileage limit, with a median fee of $150.

Ultimately, the majority of people who completed at least one lease regretted their decision to lease rather than own – only 27% said they had no regrets regarding their lease. Nearly half of lessees said they slightly regretted their lease, almost 1 in 5 were considerably regretful, and 9% reported being very regretful.

If you do lease a car, it’s best to go in prepared for add-on costs like turn-in fees. People who were surprised by their turn-in fees were much more likely than those unsurprised by fees to regret their lease.

Who Takes Better Care of Their Car?

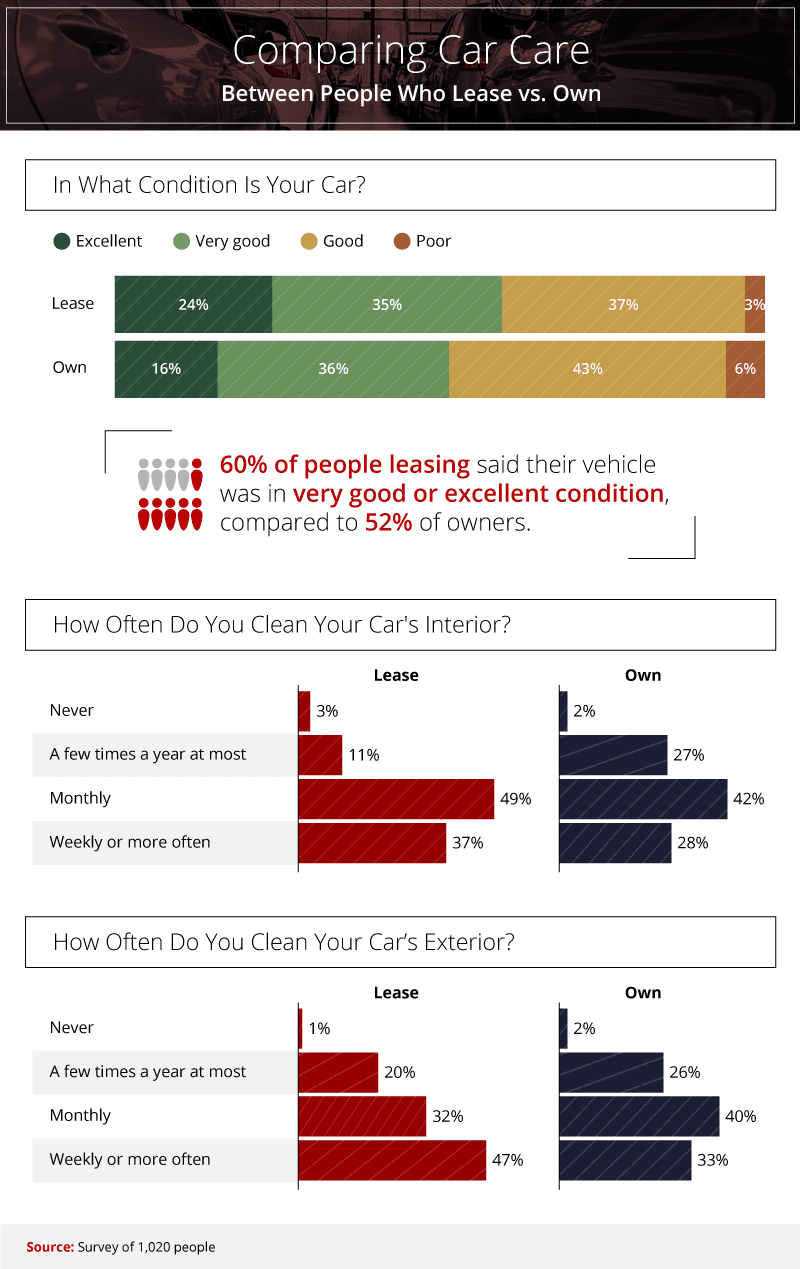

Given the unhappy surprise that can come with wear and tear fees, we wondered if people who lease took better care of their cars. It would appear the answer is yes: 60% of people leasing their vehicle said their car is in excellent or very good condition, compared to only 52% of people who own.

People who lease were significantly more likely to rate the condition of their car as excellent and far less likely to rate their car’s condition as poor. Interestingly, owners were slightly more likely to label their car as in very good condition but far more likely than lessees to rate their car’s condition as just good.

People who lease were also more likely to clean their vehicle regularly than those who own. Over three-quarters of lessees reported cleaning their car’s interior at least monthly, compared to 70% of car owners. Similarly, nearly 80% of lessees cleaned their car’s exterior at least once a month, whereas only 73% of car owners could say the same.

How to Get Out of a Car Lease

If surprise turn-in fees or regular maintenance don’t sound like your idea of a good car lease, there is a third option: letting another company buy you out of your lease.

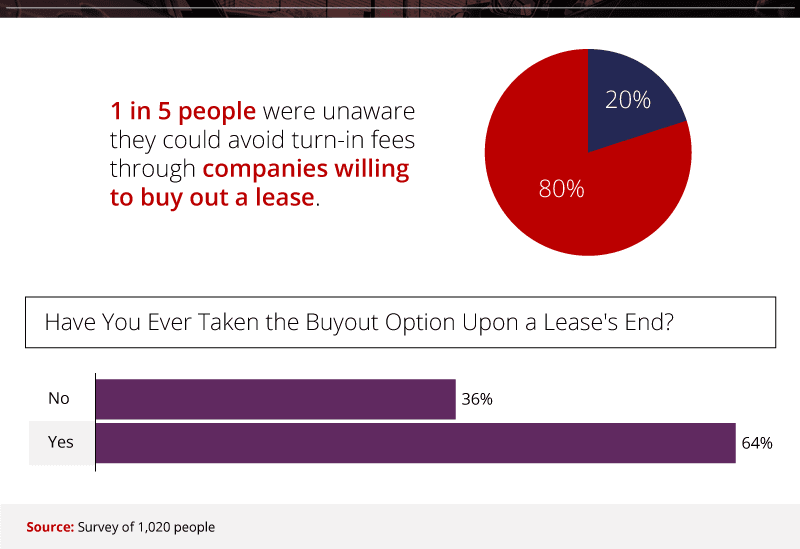

In this scenario, you can take your leased vehicle to a third party – not the company you leased it from – and let them buy your car at the trade-in price. This third-party company will then pay the company you lease from for the remainder of the lease and give you a check for the car’s value. Note that you may not get the check right away – some companies may wait for the title to clear before mailing you your check. One in 5 people were familiar with this strategy to avoid turn-in fees.

Another option to avoid turn-in fees is to do a lease buyout. Instead of turning in your leased vehicle at the end of the term, you pay the residual amount to own the car outright. In this case, you wouldn’t have to pay an additional fee if you went over your mileage allotment or didn’t keep your car in perfect shape.

To Sell or Not to Sell Your Luxury Car

Whether you should buy or lease a vehicle ultimately comes down to what’s important to you and what you can afford financially. If you need to keep your initial cost low, leasing may be a better option – as long as you’re prepared for potentially higher insurance and turn-in fees. When you own a car, you’ll often need to pay more money upfront, but then your car and what you do with it is entirely up to you. You can customize it, drive it, and insure it (or not) to your heart’s desire.

The challenge for both owners and lessees can be when you want to trade in or sell your car – a process that’s particularly difficult for luxury or exotic vehicles. At WeBuyExotics.com, we make the selling process as easy as possible for high-end car owners. We even pay off luxury car leases.

Our appraisers will give you a no-obligation cash offer on your exotic vehicle in minutes. No phony negotiating tactics and no hardball. If you have a supercar, luxury SUV, luxury sedan, or exotic sports car you’re thinking of selling, head over to WeBuyExotics.com to get your free quote today.

Methodology and Limitations

We conducted a survey of 1,020 people who had leased or owned a vehicle and asked them questions about their preferences.

Sixty percent of respondents said they had only owned, 9% said they had only leased, and 31% said they had both owned and leased a vehicle.

Fifty-nine percent of respondents identified as men, 41% identified as women, and less than 1% identified as a gender not listed by our study.

Fifty percent of respondents were millennials, 29% were Generation X, 16% were baby boomers, and 5% belonged to other generations in which the sample size was too low to explore further.

Percentages may not round to 100 due to rounding.

It is possible that with a greater sample size of certain demographics, we may have been able to gain better insights into their opinions and experiences. These results are based on self-report and are subject to issues such as exaggeration, attribution, and selective memory. No statistical testing was conducted, and results are based on means alone and, as such, are presented for informational purposes.

Fair Use Statement

Choosing whether to lease or own a vehicle is a big decision, but hopefully reading this has helped make it easier. If you found the information here valuable, please feel free to share it with others. We ask that you share it only for noncommercial purposes and include a link back to this page so that others can appreciate the content in full. This also allows our creators to get credit for their hard work.

WHY US

WHY US

SELL YOUR CAR

SELL YOUR CAR

TESTIMONIALS

TESTIMONIALS

FAQ

FAQ

CONTACT US

CONTACT US